portland oregon sales tax 2021

Beginning April 2021 employers are able to remit withholding tax payments and file. The cities and counties in Oregon do not impose any sales tax either.

Spend Family Time Outdoors At Champoeg State Park And Rest Your Head In Wilsonville In 2021 Visit Oregon Oregon State Parks

The County sales tax rate is.

. Oregon law doesnt allow you to reduce your Oregon taxes because you paid sales taxes in another state. 17981 the number of Oregon jobs in. PORTLAND Ore Feb.

The Wayfair decision and online sales tax On June 21 2018 the US. That means capital gains can be taxed at a rate as high as 99 depending on your total income. There are no local taxes beyond the state rate.

Tax rates last updated in January 2022. Saturday January 15 2022 800 AM to 500 PM. Sales tax region name.

Portland Tourism Improvement District Sp. The Portland Oregon general sales tax rate is 0The sales tax rate is always 0 Every 2021 Q2 combined rates mentioned above are the results of Oregon state rate 0. Lowest sales tax NA Highest sales tax NA Oregon Sales Tax.

Capital gains in Oregon are subject to the normal personal income tax rates. This is the total of state county and city sales tax rates. Page 1 of 3 Form CES-2020 Instructions Rev.

Corporations exempt from the Oregon Corporation Excise Tax under ORS 317080 generally not-for-profit corporations. Average Sales Tax With Local. Oregons median income is 73097 per year.

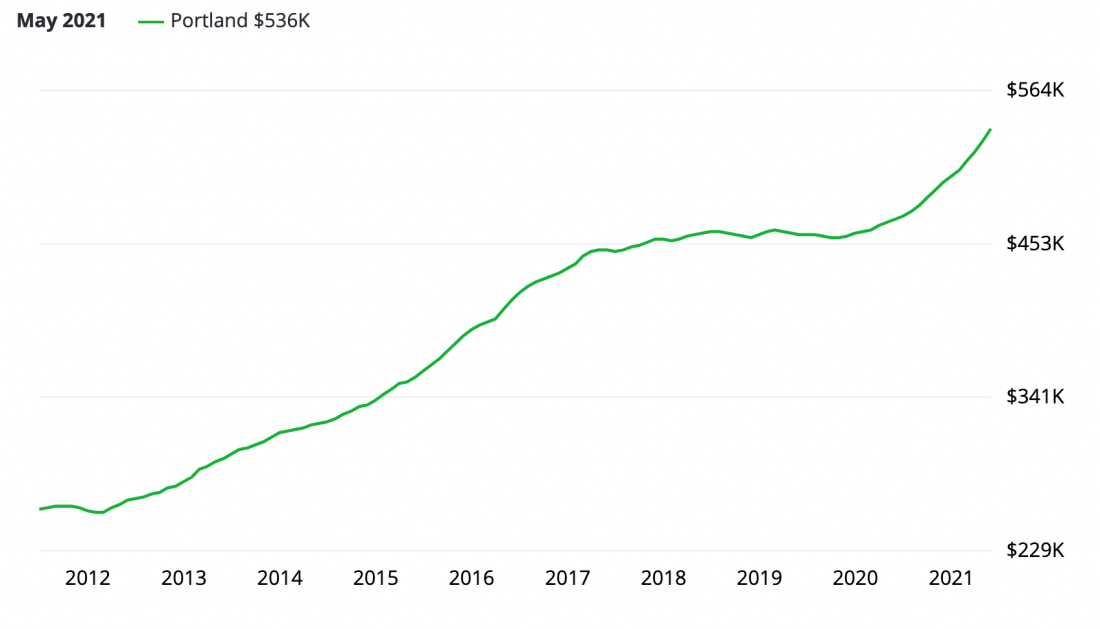

For example if you want to purchase a home in the popular burgeoning city of Portland Oregon which falls within the boundaries of Washington County and pay the median selling price of 467600 the total transfer tax will come to 46760. The combined rate used in this calculator 0 is the result of the Oregon state rate 0. The median property tax in Oregon is 224100 per year for a home worth the median value of 25740000.

Rate variation The 97220s tax rate may change depending of the type of purchase. In Alabama the sales tax rate is 4 the sales tax rates in cities may differ to upto 5. Beginning January 1 2021 certain businesses and individuals in Washington Clackamas and Multnomah counties the Metro will become subject to the Portland Payroll Tax.

111 SW Columbia St Suite 600 Portland Oregon 97201. The Oregon sales tax rate is currently. 1109959000 the dollar amount of weed sales in Oregon in 2020.

1 tax on businesses with gross receipts over 5 million per year. Use Fuel 038 per gallon. How 2021 Q1 Sales taxes are calculated for zip code 97220.

Oregon imposes new local income taxes for Portland Metro and Multnomah County. Fill in the amount of motor vehicle fuel sales included in Portland Retail Sales on line 3. Oregon has no state sales tax and allows local governments to collect a local option sales tax of up to NA.

Portland and Multnomah County Business Taxes due date for September FYE. POR today reported net income based on generally accepted accounting principles GAAP of 244 million or. There are six additional tax districts that apply to some areas geographically within Portland.

Ad Find Out Sales Tax Rates For Free. Use fuel includes premium diesel biodiesel and any fuel other than gasoline used to propel a motor vehicle on public roads. Jet Fuel 003 per gallon.

Due date of Combined Tax Return or six-month extension request for filers with a September fiscal year end. BY THE NUMBERS. Method to calculate Portland sales tax in 2021.

There is no sales tax for 97220 Portland Oregon. 2021 List of Oregon Local Sales Tax Rates. While Oregon does not have a general sales tax it does tax the sale of alcohol.

The state sales tax rate in Oregon is 0000. How 2021 Q2 Sales taxes are calculated in Portland. Aviation Gasoline 011 per gallon.

Oregon fuel tax rates are as follows. Information about Portland Business License Tax Multnomah County Business Income Tax and Metro Supportive Housing Services. The minimum combined 2022 sales tax rate for Portland Oregon is.

Oregon is one of 5 states that does not impose any sales tax on purchases made in the state the others being Alaska Delaware Montana and New Hampshire. For propane and natural gas dispensed into motor vehicles use. The Sales tax rates may differ depending on the type of purchase.

The Portland sales tax rate is. Gasoline 038 per gallon. Heres the straight dope on Oregons cannabis industry.

Oregon Capital Gains Tax. As we all know there are different sales tax rates from state to city to your area and everything combined is the required tax rate. There is no county sale tax for Portland OregonThere is no city sale tax for Portland.

Effective January 1 2021 two new Oregon local income taxes apply the Portland Metro Supportive Housing Services Income Tax and the Multnomah County Preschool for All Income Tax. The average home price in Portland Oregon is much lower than the average house costs in nearby cities like Seattle. Fast Easy Tax Solutions.

1 tax on taxable income of more than 125000 for individuals and 200000 for joint-filers. Supreme Court ruled a state may collect sales tax from taxpayers located outside the state if they are selling to state residents and there is a sufficient connection. 17 2022 PRNewswire -- Portland General Electric Company NYSE.

20 Honest Pros And Cons Of Living In Portland Oregon Tips

Best Airbnbs In Portland Oregon 19 Top Places To Stay In 2021 Magical Vacations Travel Vacation Trips Oregon Travel

2021 Portland Tax Changes Bluestone Hockley Portland Property Management

2021 Portland Tax Changes Bluestone Hockley Portland Property Management

2021 Portland Tax Changes Bluestone Hockley Portland Property Management

No Sales Tax In Oregon Pioneer Place Mall Downtown Coach Gap Kate Spade J Crew Louis Vuitton Tiffany Co Tor Downtown Portland Oregon Travel Portland

2021 Portland Tax Changes Bluestone Hockley Portland Property Management